Could the transition to renewables give rise to a new OPEC?

OPEC and its affect on crude oil prices.

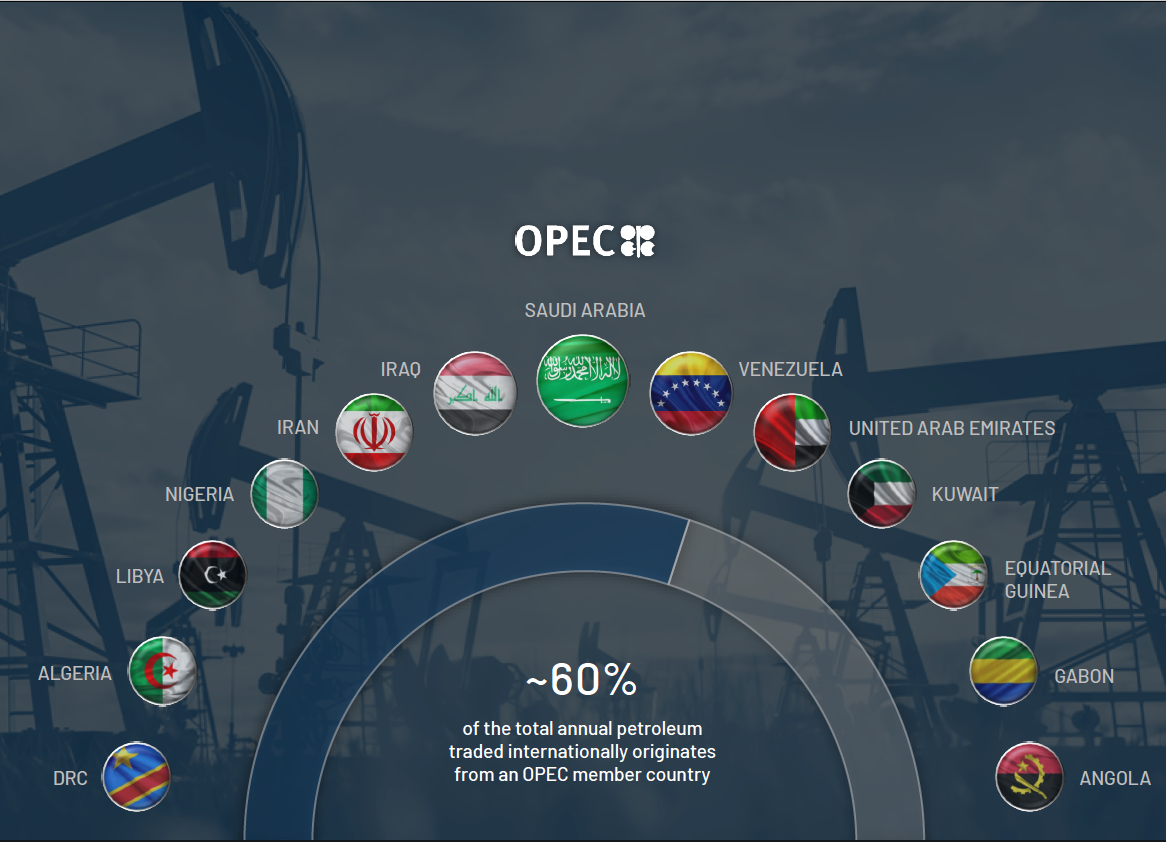

The Organization of the Petroleum Exporting Countries, OPEC, was established in 1960, with five founding members: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. OPEC’s primary objective was to unify petroleum policies and secure fair prices for its member countries, which has since expanded to include 13 core members. According to current estimates, 80.4% of the world’s proven oil reserves are located in OPEC Member Countries, with the bulk of OPEC oil reserves in the Middle east, amounting to 67.1% of the OPEC total.1 Central to OPEC’s power is its ability to leverage its collective influence to manipulate global supply and demand dynamics, thereby influencing prices. Reductions in production create market scarcity, driving prices upward, while increases result in a surplus, leading to price decreases. Decisions on production quotas are made during OPEC meetings, where member nations negotiate and coordinate their strategies.

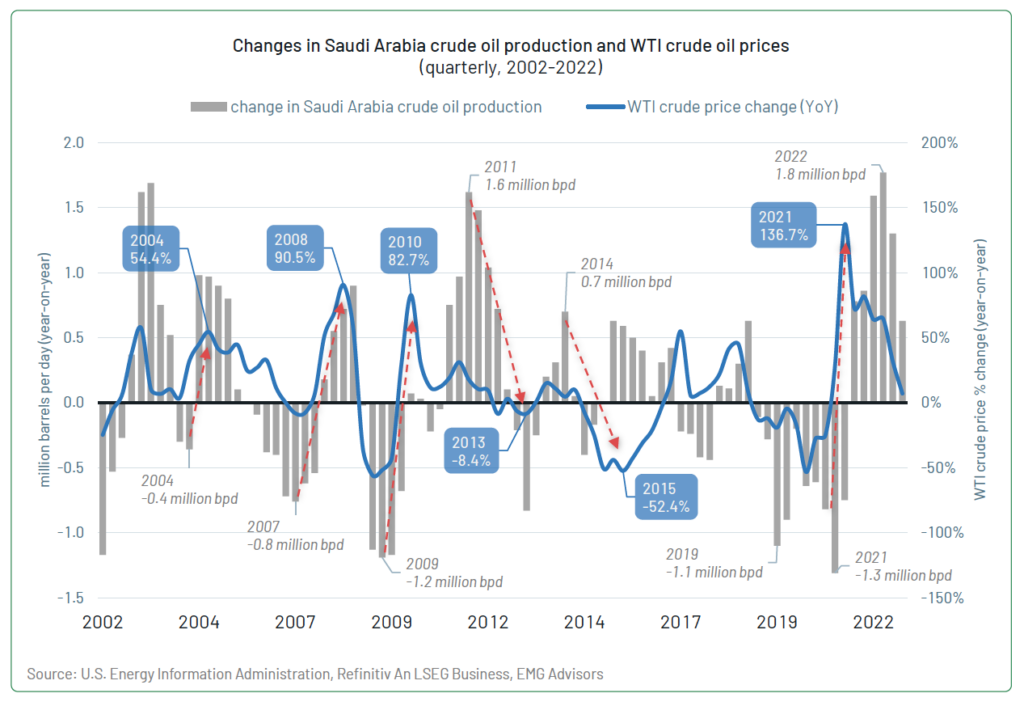

According to the US Energy Information Administration, OPEC’s oil exports represent about 60% of the total petroleum traded internationally (see graphic on cover page).2 This market share allows the cartel to influence international oil prices; the chart below demonstrates how its largest producer, Saudi Arabia, frequently affects oil prices.

The oil markets respond to changing supply and demand expectations; forecast reduced production and price goes up, forecast increased production and price goes down.

This is just one example of the strength of OPEC’s influence on international oil prices. Each member also calculates and monitors its spare production capacity to be able to respond to potential crises that reduce oil supplies; as a result, oil prices tend to incorporate a rising risk premium when OPEC spare capacity reaches low levels.

The United States is on the cliff of its third energy revolution in 100 years.

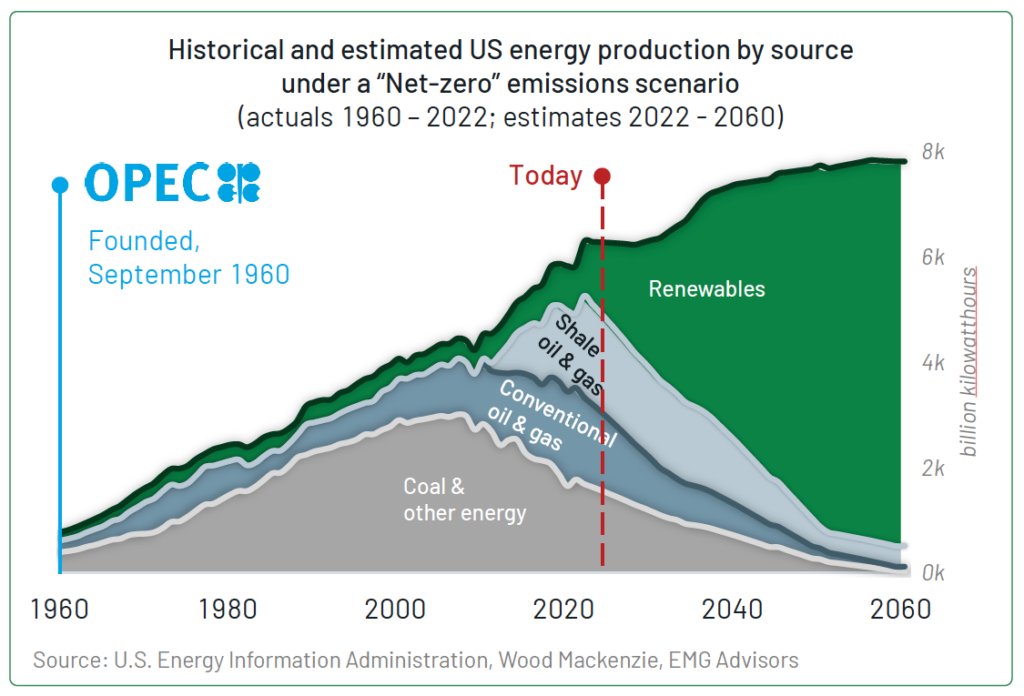

The chart to the right is a timeline of energy production in the US by source since 1960, when OPEC was established. Coal and conventional oil & gas have been the primary source of energy production for the past 60 years, with shale oil & gas gaining popularity in the last decade. Up to this point, renewables have only played a minor role in US power generation; in order to fulfill the promises of a net-zero emissions scenario by 2030, 2040, or 2050…wherever the target is now!

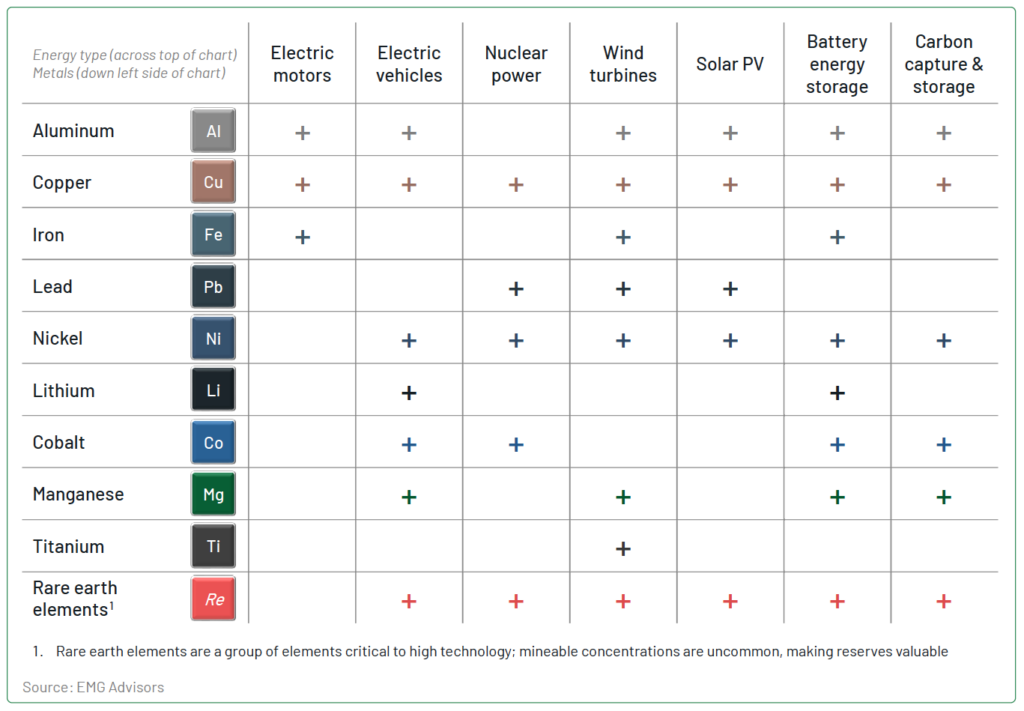

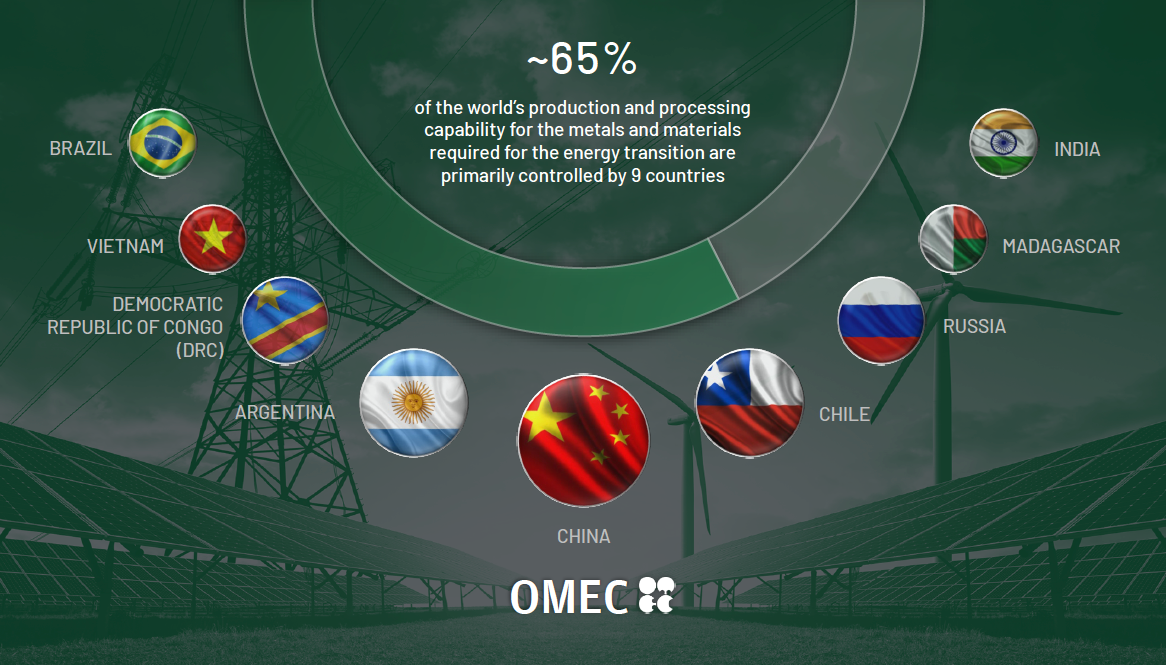

The shift from a fuel-intensive to a material-intensive energy system powered by renewables will rely on a supply chain for critical minerals and rare earth metals controlled by only a handful of countries.

What will fuel our green future?

Where is this fuel coming from?

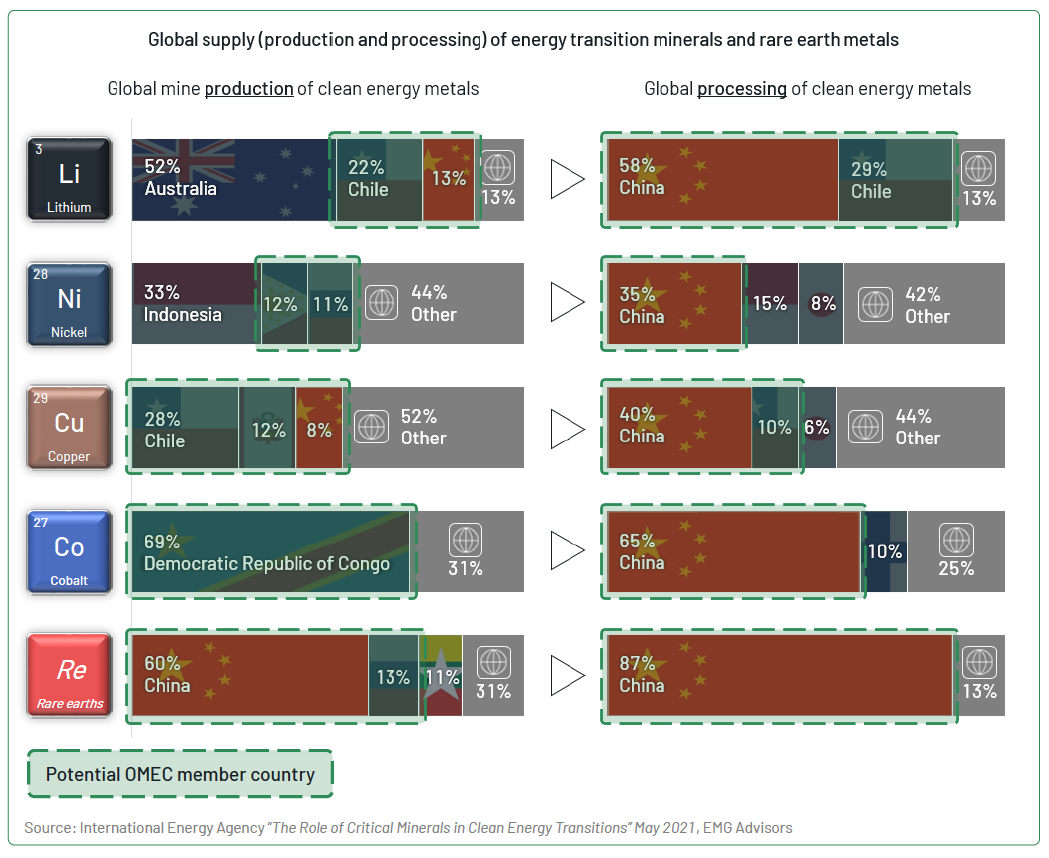

The materials necessary for our smart phones, high technology devices, consumer and industrial batteries, electric vehicles, renewable energy infrastructure, all require the metals and rare earth elements whose supply is currently controlled by a small group of countries, led by China.

China has emerged as a dominant force in the processing of these raw materials into usable forms, driven by domestic resource availability, cost-effective labor, and advanced processing technologies. An underlying reason for China’s preeminence is the hesitation of many countries to engage in environmentally impactful processing activities associated with critical minerals. The processing journey from raw materials to refined forms involves extraction, beneficiation, smelting, and refining; processes that generate waste, release pollutants, and have adverse ecological effects on the environment. China’s willingness to engage in processing activities, albeit with varying environmental standards, has allowed it to become a global bottleneck in the green-energy metal supply chain.

This bottleneck extends to both processed raw materials and finished goods (wind turbines, electric vehicle batteries, and battery energy storage systems) contributing to China’s dominance in the sector. As the world strives for renewable energy solutions, the reliance on China for processing and manufacturing introduces potential vulnerabilities in supply chains, affecting availability and affordability.

Where are the clean-energy technologies manufactured?

Answer: China

On average, China controls 75% of the manufacturing of clean energy technologies, infrastructure, and components listed below. It has the distinct advantage of low raw material costs (it’s buying processed raw material from itself), low manufacturing costs, and sustained policy support and investment.

To recap, China controls a portion of the mine supply, a significant majority of the processing, and an even more significant majority of the manufacturing of clean-energy technologies. They are vertically integrated; a term that describes a business strategy in which a company owns or controls different stages of the supply chain of a product or service.

So what will the largest consumers of renewables and clean-energy technologies, the US & Europe, do if China decides to turn off the spout for say, a raw material…we’re about to find out.

On July 4th (of all days) China announced a curb on exports of Gallium and Germanium, two of the rare earth elements critical to chipmaking and electronics.

It’s not just a China problem…the risk of a new OPEC is real.

Argentina and Chile has the world’s second- and third-largest reserves of Lithium, respectively. Those countries, along with their neighbor Bolivia, make up the “Lithium Triangle”. The US imports roughly 91% of its lithium from the Lithium Triangle, primarily Chile.

At the end of April 2023, Chile’s President announced the nationalization of its lithium reserves, which could signal the imminent rise of protectionist measures on a global scale, with a focus on these core green energy metals and rare earths. Our reliance on lithium is set to grow even further. Recently, MIT scientists created a solid-state lithium battery that surpasses the performance of current battery technologies5. As newer technologies demand even greater quantities of lithium, the US is likely to accept the nationalization of, and its short- to medium-term dependence on, Chilean lithium, while exploring alternative sources in countries with more favorable business environments.

As the world accelerates its shift towards renewable energy, the concentration of green-energy metal reserves and processing capabilities in a limited group of countries raises concerns about pricing power and supply chain resilience; this could give rise to a new cartel of metal exporting countries, OMEC.

The United States, Europe, and other developed nations, as major consumers of these materials, will have to deal with this group…but it’s likely that China will be setting the price for now.

- https://www.opec.org/opec_web/en/data_graphs/330.htm

- https://www.eia.gov/finance/markets/crudeoil/supply-opec.php

- https://www.emgadvisors.com/wp-content/uploads/fund-docs/chrg/CHRG-InvestmentCase.pdf

- https://www.cnbc.com/2023/07/04/what-are-gallium-and-germanium-china-curbs-exports-of-metals

- https://scitechdaily.com/mit-discovery-could-unlock-a-safer-and-lighter-lithium-battery

Investing in ETF’s involves risk, including possible loss of principal. International investing may be subject to special risks, including currency exchange rate volatility, political, social or economic instability, less publicly available information, less stringent investor protections, and differences in taxation, auditing and other financial practices. Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. The Fund invests in securities of companies of all sizes, including those that have relatively small market capitalizations. Investments in securities of these companies involve greater risks than do investments in larger, more established companies. Derivatives include instruments and contracts that are based on, and are valued in relation to, one or more underlying securities, financial benchmarks or indices, such as futures, options, swap agreements and forward contracts. The Adviser may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser may increase the volatility of the Fund. Because the Fund invests in financial instruments that are linked to different types of commodities from the metals sector, the Fund is subject to the risks inherent in the metals sector. Such risks may include, but are not limited to: general economic conditions or cyclical market patterns that could negatively affect supply and demand in a particular industry; changes in environmental conditions, energy conservation and environmental policies; competition for or depletion of resources; adverse labor relations; political or world events; increased regulatory burdens; changes in exchange rates; imposition of import controls; obsolescence of technologies; and increased competition or new product introductions. The exploration and development of mineral deposits involve significant financial risks over a significant period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. The Fund invests in companies that are economically tied to the lithium industry, which may be susceptible to fluctuations in the underlying commodities market. Commodity prices may be influenced or characterized by unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, changes in interest rates and monetary and other governmental policies, action and inaction. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated on a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns shown do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. NAVs are calculated using prices as of 4:00 PM Eastern Time.

The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF is distributed by Quasar Distributors, LLC.

Investors should carefully consider the investment objectives, risks, charges and expenses of the The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by calling 1-800-617-0004 or visiting www.emgadvisors.com. The Prospectus should be read carefully before investing.