Author: Corestone Capital

Chinese Control of Green Energy Metals

As countries all around the world pursue the transition from fossil fuels to renewables, green energy metals are becoming increasingly important. World leaders are jostling for control over the production and processing of lithium, copper, cobalt, nickel and others, rewriting geopolitical lines and adding new impetus to ongoing (and potentially new) conflicts.

China has emerged as the dominant force, which is adding to existing tensions with the West. But the competition for influence over supply dynamics also offers an opportunity for investors to profit from the growing trade and blossoming demand for green energy metals (including rare earth elements). While some may categorize it as a battery ETF, a raw commodities product like CHRG ETF makes it possible to benefit from global trends no matter who dominates supply.

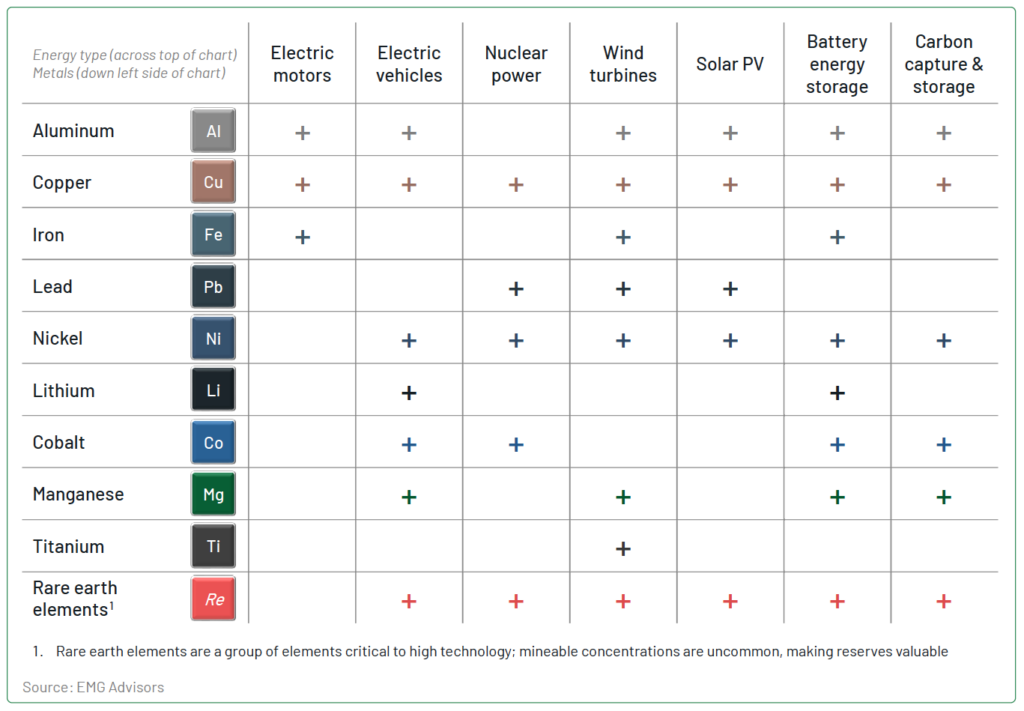

Green Energy metals are growing in importance

The green energy transition – with power generation from solar, wind, and other renewables -, is expected to expand 300% from 2020 levels by 20351. This requires green energy metals, particularly copper for the miles of wires and cables, and lithium, cobalt, and nickel for the batteries that store green energy and power electric vehicles (EVs). Global demand is predicted to outpace supply within the next decade2.

As the world’s largest processor of these green metals, and the world’s largest manufacturer of green energy technologies, China desperately needs to secure its own supply chain to maintain its global position. It’s estimated to have just 16% of the mined copper it requires, leaving it short around 7.5 million tonnes (Mt) a year and pushing for increased production3.

Analysts at Wood Mackenzie calculate that even the base case scenario will see the world’s nickel production rise by almost 80% in the next 20 years, cobalt demand by 180%, and lithium by 510%, and that’s the lower estimate4. If this race to decarbonization continues to accelerate, demand for green energy technologies will outpace supply, which in theory should lead to price appreciation across the supply chain, including the raw materials.

This makes direct commodity exposure through a nickel, cobalt, or copper ETF highly appealing for investors looking for opportunities. But nation states that have net zero targets are just as eager to profit from green energy metals, and even more importantly, to take control over their supply chains of these in-demand minerals. And China is leading the run.

China dominates the green energy metal trade

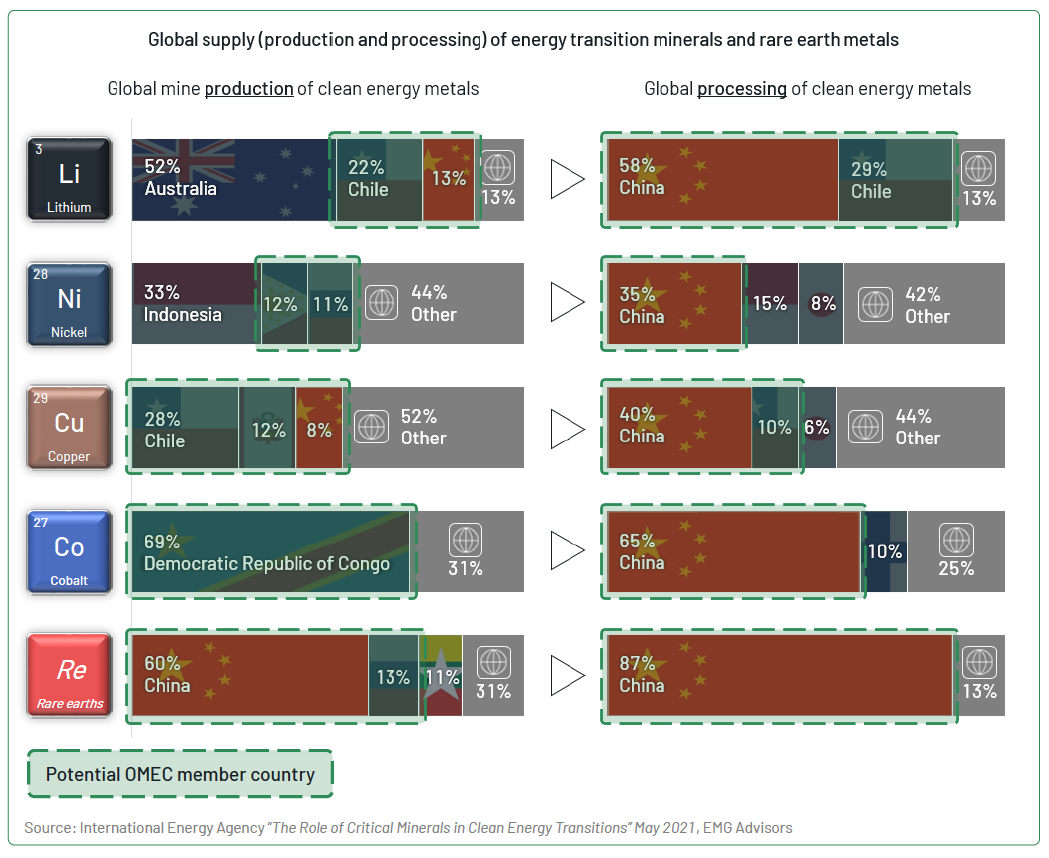

While green energy metals are abundant in the planet as a whole, there are very few areas where they can be found in mineable quantities. Copper is mined largely in Chile and Peru; the highest concentrations of nickel are in Indonesia, Australia, and the US; lithium in Chile, Argentina, Australia, and China; and over 60% of cobalt is mined the Democratic Republic of Congo5.

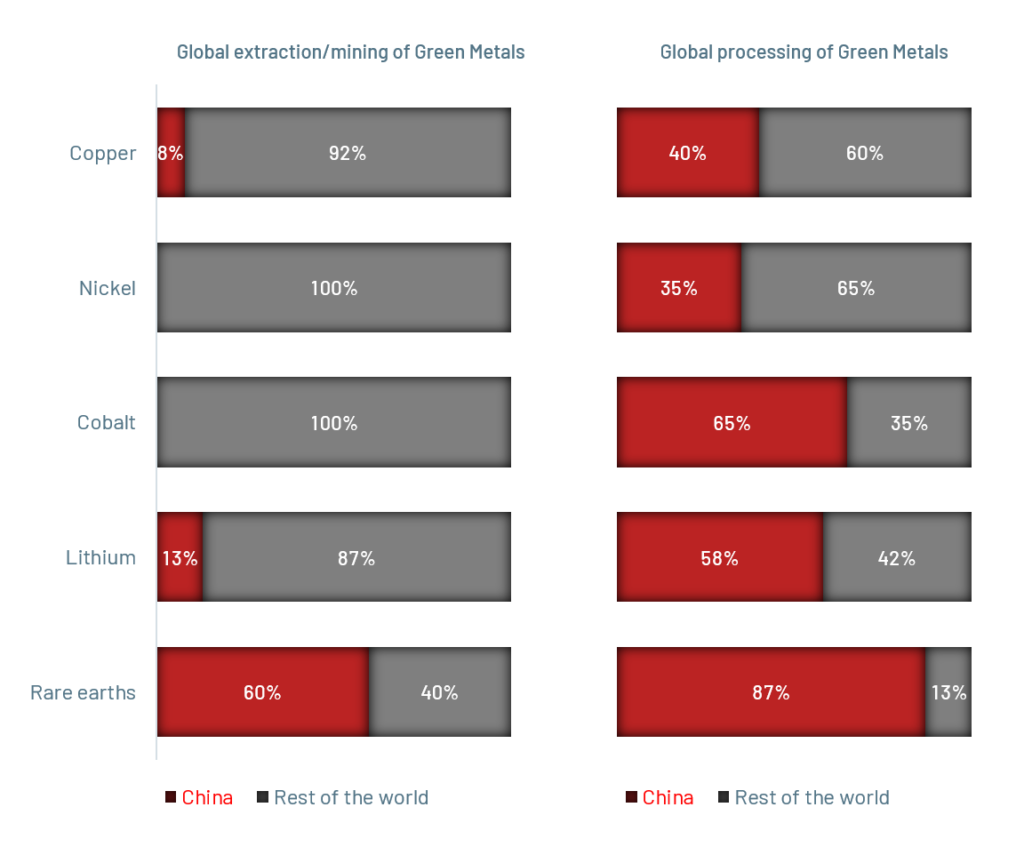

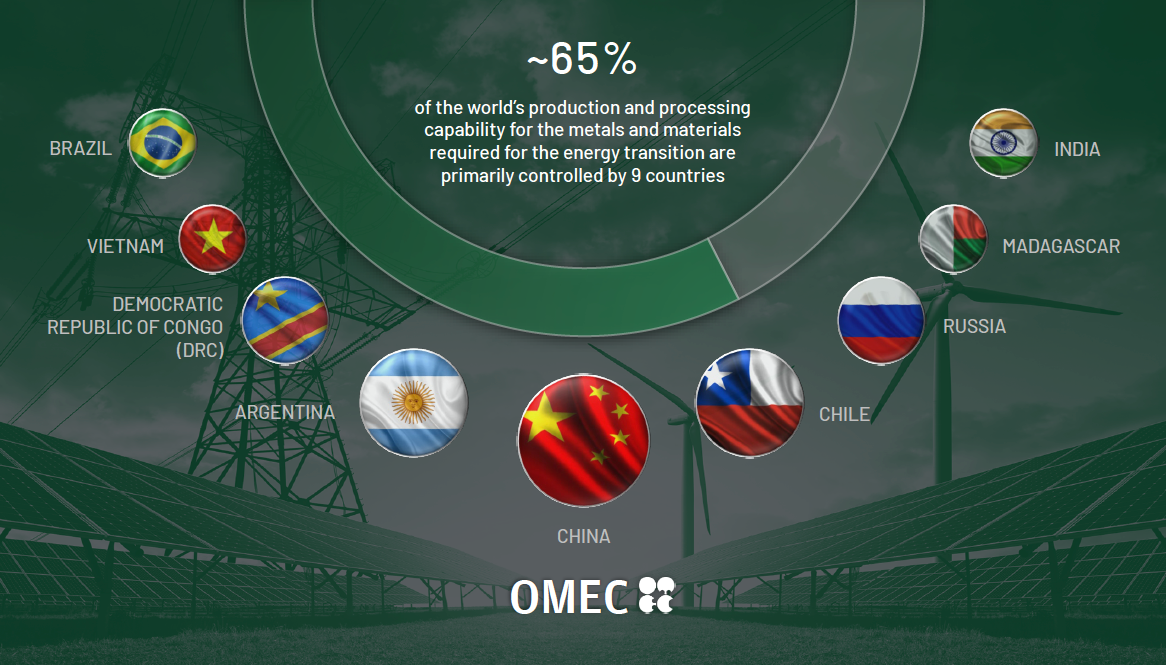

But as shown on the graph below, while mining activities are somewhat scattered around the world, the minerals are mostly processed in China.6

China manages the vast majority of the production of components needed for renewables. 85% of the world’s lithium-ion battery production, 50% of EVs, and close to 70% of solar panels are made in China, and it’s the biggest manufacturer of wind turbines7.

In contrast, the US is currently lagging far behind. It has very few domestically-produced key components8, and EV battery manufacturing capacity is approximately 50% and 63% of that needed by its home EV market in 2023 and 20249, yet it is one of the largest consumers of the finished products!.

China’s dominance is no accident. It was late to the fossil fuel game, which left it dependent on others for most of its energy up till now. It’s determined not to repeat the mistake with clean energy. The CCP’s plan for energy independence requires control over both the production of clean energy systems, and the green energy metals supply chain.10

According to Wood Mackenzie’s Gavin Thompson, Huang Miaoru, and Zhou Yanting, China’s blueprint for net zero is “the most important energy-market document in history. It will shift the global balance of power.”11

Other countries are jostling for a share

In fact, it already is. The US and Europe see the power that OPEC has regarding oil, and OPEC controls approximately 60% of the trade. China’s share of green energy metals trade is already higher, provoking governments around the world to find ways to restrict it.12

In the US, the recent Inflation Reduction Act (IRA) set aggressive targets and incentives to reshore mineral processing and production for components such as photovoltaic cells and EV batteries, and ally-shore a rare earths supply chain. The US is not alone; Wood Mackenzie chairman and chief analyst Simon Flowers observes that “every country pursuing Net Zero wants to do what the US is doing – establish its own domestic low carbon supply chain to reduce dependence on China”13.

But the reality is that very few green energy metal supply chains exclude China, and many companies and countries will be competing for them. The stakes are high for green energy metal supply dynamics.

This is worrying for world leaders who are trying to check China’s dominance, but it offers a big incentive for a number of other states. Countries with significant mineable deposits could expand their share of the global trade, and others to develop the capabilities to process critical minerals mined elsewhere.

Australia is an appealing alternative for lithium, nickel, and graphite, as are many Latin American countries. Companies in areas with lower mineable resources, including Indonesia, the Philippines, Brazil, Mozambique, and Madagascar, offer mineral processing capabilities which could be ramped up.14

Much depends on the level of investment and support that Western countries offer, to help accelerate green energy metals production and processing. It’s likely that a great deal more resources will soon pour into this vertical, which in turn opens up opportunities for investors.

Investors could profit from global green energy metal competition

Investors can profit from the global race to control green energy metals, no matter which country comes out on top. With so much demand for critical minerals, metal exposure could be a valuable addition to investor portfolios. The challenge, as always, is identifying which metal stock will benefit the most.

This is why a lithium ETF, copper ETF, nickel ETF or cobalt ETF, or an electric vehicle ETF which includes EV battery stocks, can be an appealing alternative. CHRG is an ETF that tracks the raw materials needed for EV batteries, including copper, lithium, cobalt, and nickel. An ETF like CHRG enables investors to spread their investment across a number of promising commodities stocks, helping mitigate their exposure to risk and balance their portfolios.

- “100% Clean Electricity by 2035 Study,” NRELTransforming Energy, https://www.nrel.gov/analysis/100-percent-clean-electricity-by-2035-study.html#:~:text=As%20modeled%2C%20wind%20and%20solar,terawatts%20of%20wind%20and%20solar.

- “Are green energy commodities the new “safe haven” for investors?” EMG Advisors, July 6, 2023. https://www.emgadvisors.com/are-green-energy-commodities-the-new-safe-haven-for-investors/

- “Tectonic shift: China’s world-changing push for energy independence” Wood Mackenzie, March 2021

- “Tectonic shift: China’s world-changing push for energy independence” Wood Mackenzie, March 2021

- “The 3 Geo’s of Green Metals The Geographical, Geological, and Geopolitical considerations impacting the Global Energy Expansion ” CHRG presentation

- “The 3 Geo’s of Green Metals The Geographical, Geological, and Geopolitical considerations impacting the Global Energy Expansion ” CHRG presentation

- “Tectonic shift: China’s world-changing push for energy independence” Wood Mackenzie, March

- “The Edge: Cutting dependence on China’s renewables supply chain” Wood Mackenzie June 1, 2023

- “Inflation Reduction Act: Where could automakers shift their supply chains?” Wood Mackenzie, May 2023

- “Tectonic shift: China’s world-changing push for energy independence” Wood Mackenzie, March 2021

- “Tectonic shift: China’s world-changing push for energy independence” Wood Mackenzie, March

- “The 3 Geo’s of Green Metals The Geographical, Geological, and Geopolitical considerations impacting the Global Energy Expansion ” CHRG presentation

- “The Edge: Cutting dependence on China’s renewables supply chain” Wood Mackenzie June 1, 2023

- “Inflation Reduction Act: Where could automakers shift their supply chains?” Wood Mackenzie, May 2023

Investing in ETF’s involves risk, including possible loss of principal. International investing may be subject to special risks, including currency exchange rate volatility, political, social or economic instability, less publicly available information, less stringent investor protections, and differences in taxation, auditing and other financial practices. Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. The Fund invests in securities of companies of all sizes, including those that have relatively small market capitalizations. Investments in securities of these companies involve greater risks than do investments in larger, more established companies. Derivatives include instruments and contracts that are based on, and are valued in relation to, one or more underlying securities, financial benchmarks or indices, such as futures, options, swap agreements and forward contracts. The Adviser may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser may increase the volatility of the Fund. Because the Fund invests in financial instruments that are linked to different types of commodities from the metals sector, the Fund is subject to the risks inherent in the metals sector. Such risks may include, but are not limited to: general economic conditions or cyclical market patterns that could negatively affect supply and demand in a particular industry; changes in environmental conditions, energy conservation and environmental policies; competition for or depletion of resources; adverse labor relations; political or world events; increased regulatory burdens; changes in exchange rates; imposition of import controls; obsolescence of technologies; and increased competition or new product introductions. The exploration and development of mineral deposits involve significant financial risks over a significant period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. The Fund invests in companies that are economically tied to the lithium industry, which may be susceptible to fluctuations in the underlying commodities market. Commodity prices may be influenced or characterized by unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, changes in interest rates and monetary and other governmental policies, action and inaction. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated on a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns shown do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. NAVs are calculated using prices as of 4:00 PM Eastern Time.

The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF is distributed by Quasar Distributors, LLC.

Investors should carefully consider the investment objectives, risks, charges and expenses of the The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by calling 1-800-617-0004 or visiting www.emgadvisors.com. The Prospectus should be read carefully before investing.

Could the transition to renewables give rise to a new OPEC?

OPEC and its affect on crude oil prices.

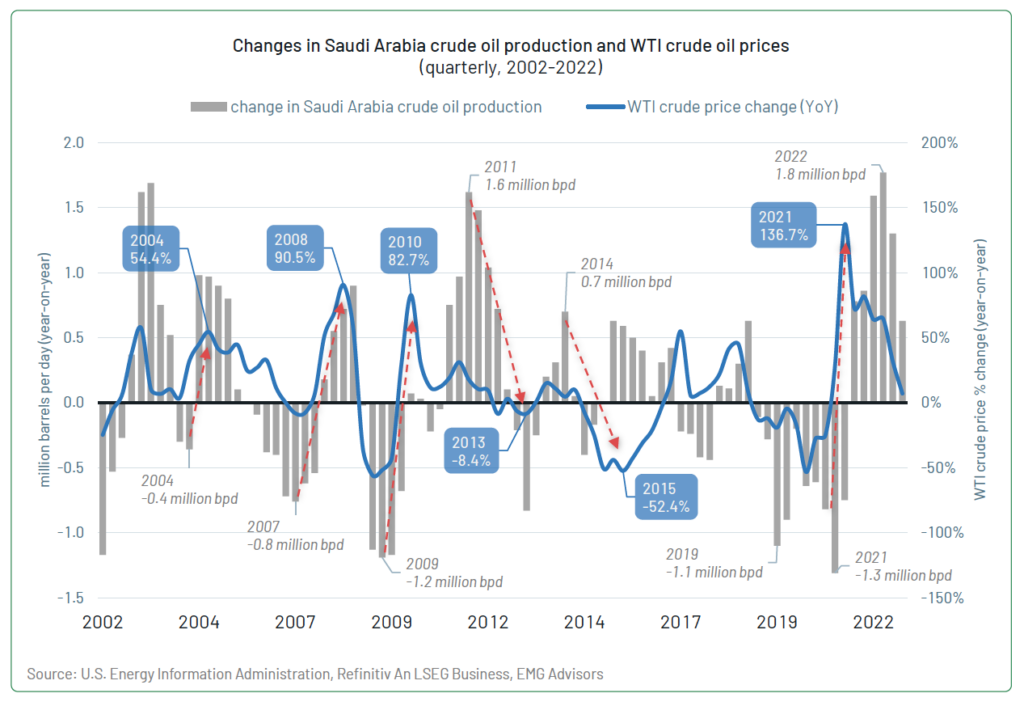

The Organization of the Petroleum Exporting Countries, OPEC, was established in 1960, with five founding members: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. OPEC’s primary objective was to unify petroleum policies and secure fair prices for its member countries, which has since expanded to include 13 core members. According to current estimates, 80.4% of the world’s proven oil reserves are located in OPEC Member Countries, with the bulk of OPEC oil reserves in the Middle east, amounting to 67.1% of the OPEC total.1 Central to OPEC’s power is its ability to leverage its collective influence to manipulate global supply and demand dynamics, thereby influencing prices. Reductions in production create market scarcity, driving prices upward, while increases result in a surplus, leading to price decreases. Decisions on production quotas are made during OPEC meetings, where member nations negotiate and coordinate their strategies.

According to the US Energy Information Administration, OPEC’s oil exports represent about 60% of the total petroleum traded internationally (see graphic on cover page).2 This market share allows the cartel to influence international oil prices; the chart below demonstrates how its largest producer, Saudi Arabia, frequently affects oil prices.

The oil markets respond to changing supply and demand expectations; forecast reduced production and price goes up, forecast increased production and price goes down.

This is just one example of the strength of OPEC’s influence on international oil prices. Each member also calculates and monitors its spare production capacity to be able to respond to potential crises that reduce oil supplies; as a result, oil prices tend to incorporate a rising risk premium when OPEC spare capacity reaches low levels.

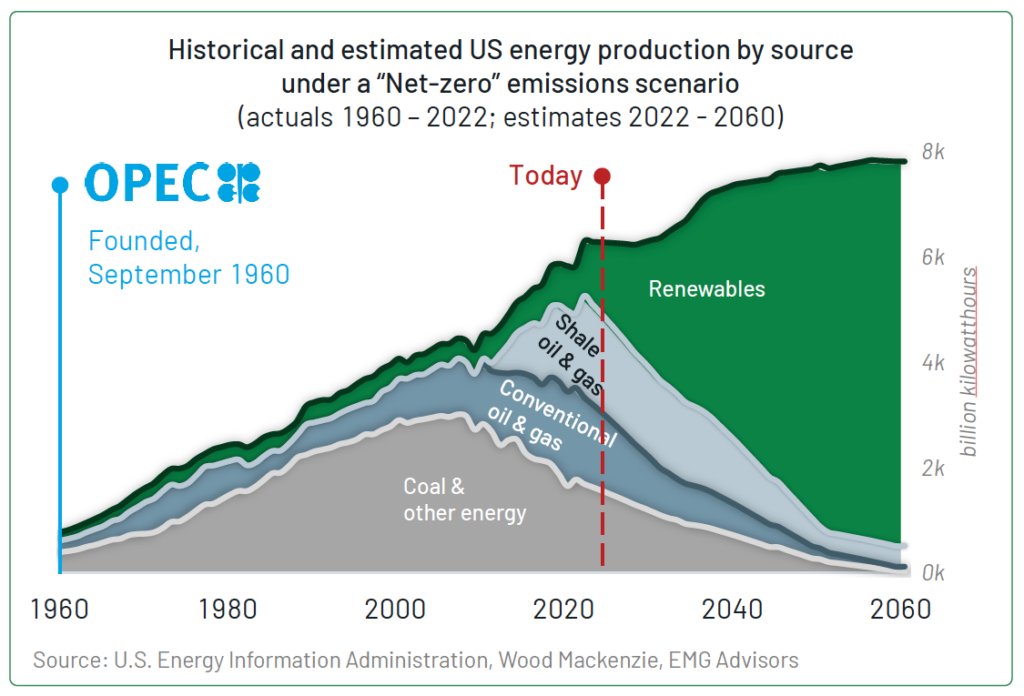

The United States is on the cliff of its third energy revolution in 100 years.

The chart to the right is a timeline of energy production in the US by source since 1960, when OPEC was established. Coal and conventional oil & gas have been the primary source of energy production for the past 60 years, with shale oil & gas gaining popularity in the last decade. Up to this point, renewables have only played a minor role in US power generation; in order to fulfill the promises of a net-zero emissions scenario by 2030, 2040, or 2050…wherever the target is now!

The shift from a fuel-intensive to a material-intensive energy system powered by renewables will rely on a supply chain for critical minerals and rare earth metals controlled by only a handful of countries.

What will fuel our green future?

Where is this fuel coming from?

The materials necessary for our smart phones, high technology devices, consumer and industrial batteries, electric vehicles, renewable energy infrastructure, all require the metals and rare earth elements whose supply is currently controlled by a small group of countries, led by China.

China has emerged as a dominant force in the processing of these raw materials into usable forms, driven by domestic resource availability, cost-effective labor, and advanced processing technologies. An underlying reason for China’s preeminence is the hesitation of many countries to engage in environmentally impactful processing activities associated with critical minerals. The processing journey from raw materials to refined forms involves extraction, beneficiation, smelting, and refining; processes that generate waste, release pollutants, and have adverse ecological effects on the environment. China’s willingness to engage in processing activities, albeit with varying environmental standards, has allowed it to become a global bottleneck in the green-energy metal supply chain.

This bottleneck extends to both processed raw materials and finished goods (wind turbines, electric vehicle batteries, and battery energy storage systems) contributing to China’s dominance in the sector. As the world strives for renewable energy solutions, the reliance on China for processing and manufacturing introduces potential vulnerabilities in supply chains, affecting availability and affordability.

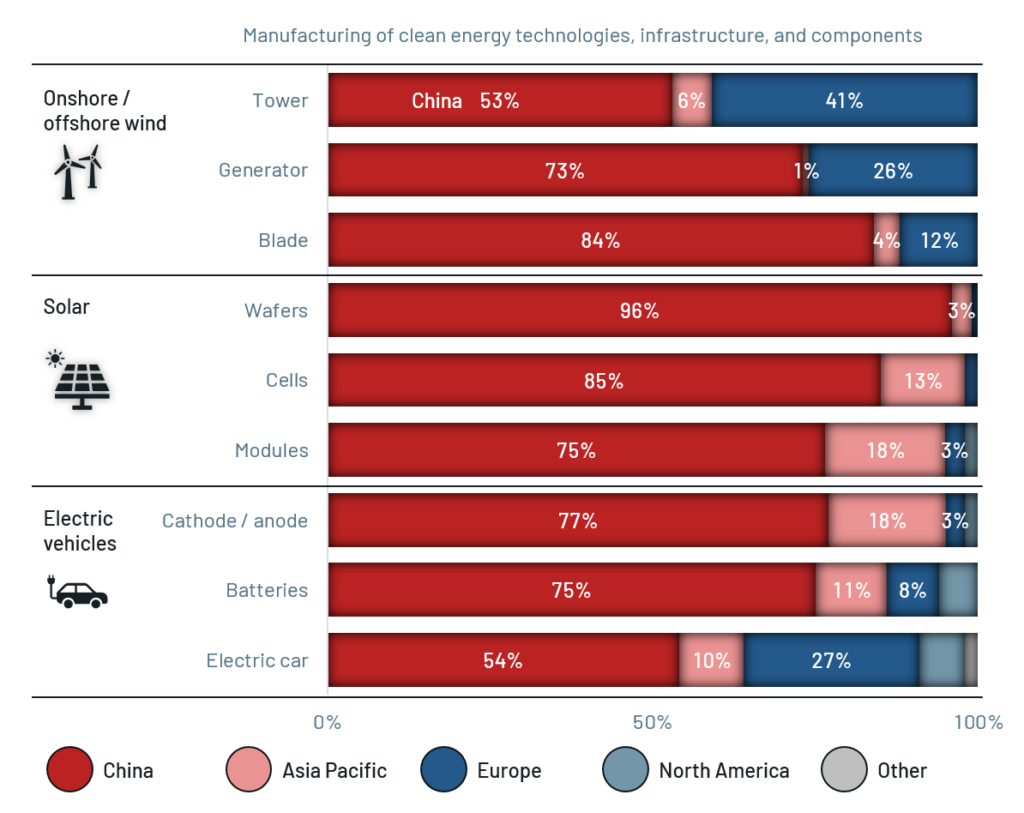

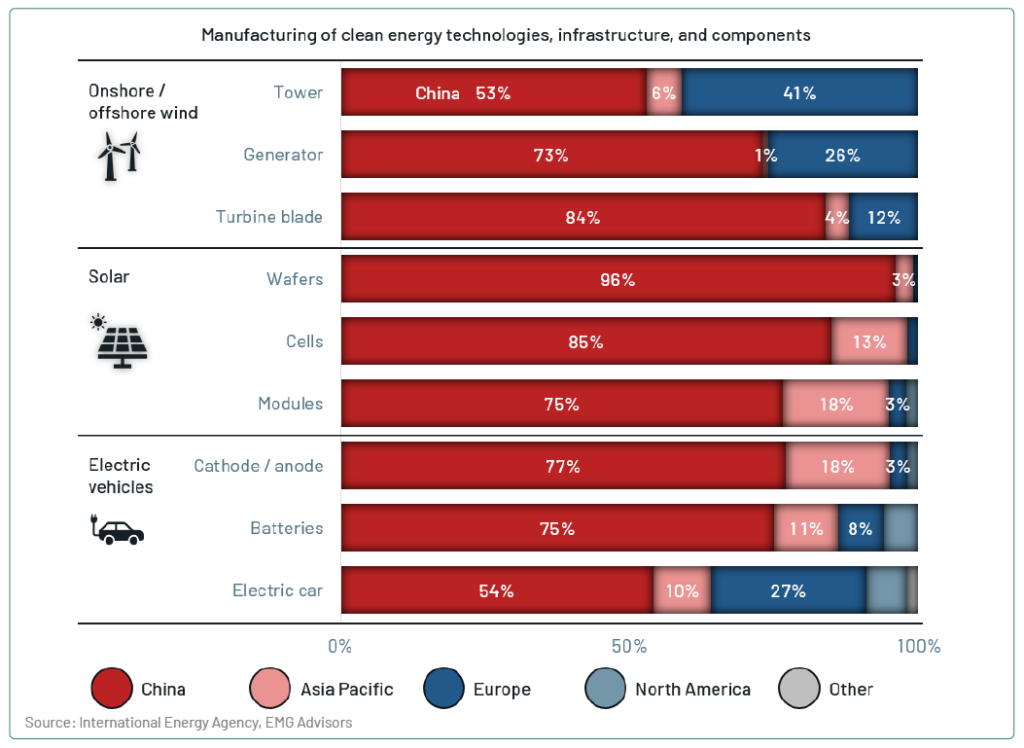

Where are the clean-energy technologies manufactured?

Answer: China

On average, China controls 75% of the manufacturing of clean energy technologies, infrastructure, and components listed below. It has the distinct advantage of low raw material costs (it’s buying processed raw material from itself), low manufacturing costs, and sustained policy support and investment.

To recap, China controls a portion of the mine supply, a significant majority of the processing, and an even more significant majority of the manufacturing of clean-energy technologies. They are vertically integrated; a term that describes a business strategy in which a company owns or controls different stages of the supply chain of a product or service.

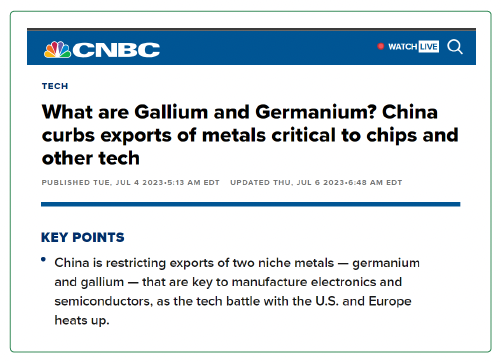

So what will the largest consumers of renewables and clean-energy technologies, the US & Europe, do if China decides to turn off the spout for say, a raw material…we’re about to find out.

On July 4th (of all days) China announced a curb on exports of Gallium and Germanium, two of the rare earth elements critical to chipmaking and electronics.

It’s not just a China problem…the risk of a new OPEC is real.

Argentina and Chile has the world’s second- and third-largest reserves of Lithium, respectively. Those countries, along with their neighbor Bolivia, make up the “Lithium Triangle”. The US imports roughly 91% of its lithium from the Lithium Triangle, primarily Chile.

At the end of April 2023, Chile’s President announced the nationalization of its lithium reserves, which could signal the imminent rise of protectionist measures on a global scale, with a focus on these core green energy metals and rare earths. Our reliance on lithium is set to grow even further. Recently, MIT scientists created a solid-state lithium battery that surpasses the performance of current battery technologies5. As newer technologies demand even greater quantities of lithium, the US is likely to accept the nationalization of, and its short- to medium-term dependence on, Chilean lithium, while exploring alternative sources in countries with more favorable business environments.

As the world accelerates its shift towards renewable energy, the concentration of green-energy metal reserves and processing capabilities in a limited group of countries raises concerns about pricing power and supply chain resilience; this could give rise to a new cartel of metal exporting countries, OMEC.

The United States, Europe, and other developed nations, as major consumers of these materials, will have to deal with this group…but it’s likely that China will be setting the price for now.

- https://www.opec.org/opec_web/en/data_graphs/330.htm

- https://www.eia.gov/finance/markets/crudeoil/supply-opec.php

- https://www.emgadvisors.com/wp-content/uploads/fund-docs/chrg/CHRG-InvestmentCase.pdf

- https://www.cnbc.com/2023/07/04/what-are-gallium-and-germanium-china-curbs-exports-of-metals

- https://scitechdaily.com/mit-discovery-could-unlock-a-safer-and-lighter-lithium-battery

Investing in ETF’s involves risk, including possible loss of principal. International investing may be subject to special risks, including currency exchange rate volatility, political, social or economic instability, less publicly available information, less stringent investor protections, and differences in taxation, auditing and other financial practices. Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. The Fund invests in securities of companies of all sizes, including those that have relatively small market capitalizations. Investments in securities of these companies involve greater risks than do investments in larger, more established companies. Derivatives include instruments and contracts that are based on, and are valued in relation to, one or more underlying securities, financial benchmarks or indices, such as futures, options, swap agreements and forward contracts. The Adviser may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser may increase the volatility of the Fund. Because the Fund invests in financial instruments that are linked to different types of commodities from the metals sector, the Fund is subject to the risks inherent in the metals sector. Such risks may include, but are not limited to: general economic conditions or cyclical market patterns that could negatively affect supply and demand in a particular industry; changes in environmental conditions, energy conservation and environmental policies; competition for or depletion of resources; adverse labor relations; political or world events; increased regulatory burdens; changes in exchange rates; imposition of import controls; obsolescence of technologies; and increased competition or new product introductions. The exploration and development of mineral deposits involve significant financial risks over a significant period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. The Fund invests in companies that are economically tied to the lithium industry, which may be susceptible to fluctuations in the underlying commodities market. Commodity prices may be influenced or characterized by unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, changes in interest rates and monetary and other governmental policies, action and inaction. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated on a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns shown do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. NAVs are calculated using prices as of 4:00 PM Eastern Time.

The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF is distributed by Quasar Distributors, LLC.

Investors should carefully consider the investment objectives, risks, charges and expenses of the The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by calling 1-800-617-0004 or visiting www.emgadvisors.com. The Prospectus should be read carefully before investing.

Are green energy commodities the new “safe haven” for investors?

So far, 2023 hasn’t brought any respite from the economic turmoil we’ve been living through for the past few years. On the contrary, the sudden collapse of Silicon Valley Bank (SVB) in March 2023 accelerated the “flight to quality” from stocks and shares into safe haven investments.

While traditional investments like gold and cash funds have seen plenty of inflows, the increasing importance of the green energy sector has also attracted investor attention. Green energy stocks, electric vehicle (EV) ETFs, and commodity ETFs like CHRG, – which some might term a copper ETF and which tracks copper stocks and other materials that are vital for green energy infrastructure and EVs, – could be the next safe haven investment as the sector experiences a once in a 100 year transition to material intensive energy and away from fossil fuels.

2023 stimulated inflows into perceived safe haven stocks

The first quarter of 2023 saw significant inflows into safe haven commodities, due to the flight to quality amid market downturns. Investors are still concerned about volatility, with widespread expectations that the Federal Reserve will raise interest rates again in May and that it will have unpredictable consequences[1].

March saw investors flock to gold after the collapse of SVB, reversing a 9-month trend of outflows. According to a report by the World Gold Council, 32 tons of precious metal, worth $1.9 billion, flowed into global gold-backed exchange-traded products in March alone. “Lower yields, a weaker dollar and safe-haven buying lifted the gold price in March by 9%, fueled by the recent banking industry crisis,” said analysts.[2] Overall, global gold ETF total assets under management (AUM) rose by 10% to US$220 billion by the end of March.[3]

Bitcoin also enjoyed perceived safe-haven inflows in Q1 2023[4], while a survey by CNBC found that cash is now the preferred safe haven on Wall Street. 60% of Wall Street investors said that cash funds are their top choice in today’s uncertain markets, and assets in money market funds rose to a record $5.2 trillion by the end of the quarter.[5]

Energy has typically been seen as another safe haven, but the sector’s performance was mixed. According to Bloomberg, the U.S. Energy sector is underperforming compared to the Broad Global Market US Index[6]. At the same time, the Allianz Group’s chief economic advisor, Mohamed El-Erian, warns that the financial markets are going through a transition where there are no entirely safe haven investments[7].

Rising green energy sector could offer a new safe haven

Safe haven investments may extend beyond gold and cash. The green and alternative energy sector has been growing consistently in recent years, showing significant growth and potential for returns. As fossil fuels fall from favor, the shift from a fuel-intensive energy system to a material-driven energy system underpinned by the green energy expansion, could offer investors a new source of returns in their energy portfolio by investing in the commodities required for this shift.

Investors have taken note of the accelerated government investment in clean energy production. In the US, the recent Inflation Reduction Act (IRA) outlines $369 billion of investment in green energy[8], and according to the Energy Policy Tracker, 2020-2021 saw G20 governments commit at least $326.13 billion for potentially clean energy and over $204.11 billion for other green energy[9].

Meanwhile, consumer demand for sustainable power isn’t going away. The catastrophic damage caused recently by floods, drought, wildfires, and intense heat helps to focus public awareness around the need to cut carbon emissions and replace polluting traditional energy with power from environmentally-friendly sources. Combined with supply concerns in the context of Russia’s Ukraine invasion, these trends are helping coalesce interest around investments in the green energy sector.

Green energy relies on copper

A handful of key materials form the foundation of the entire green energy sector, and these are emerging as an alternative safe haven commodity. Copper, in particular, is showing many encouraging signs. Copper is vital for electric wiring for green energy infrastructure; wind turbines, solar panels, electric vehicles, and other linchpins of a clean energy ecosystem all rely heavily on copper.

Today, we believe copper meets the main characteristics of a safe haven asset: it’s highly liquid, has functional uses, enjoys considerable value permanence, has inelastic and growing demand, and is in limited supply.[10] Copper demand is expected to double from 2022 to 2035, thanks to the transition to a lower carbon economy, but the commodity trader Trafigura warns that stores of copper are dangerously low, while stricter environmental laws make it harder to open new mines[11].

Analysts at The Motley Fool note that “this outlook bodes well for the copper industry,[12]” and in December 2022, Goldman Sachs suggested that copper prices could reach record high prices of $11,000 per ton in 2023[13]. It’s generally expected that while short-term price spikes will be quickly resolved, the overall value of the copper market will increase slowly but steadily over the next decade or more.

Invest in green energy sector with a copper ETF

The global transition to green energy requires masses of copper in the form of electric vehicles, energy storage infrastructure, wind turbines and solar panels, and thousands of miles of copper wiring, at the same time as supply is limited and the prospects of increasing the supply chain are slim. The last quarter has highlighted the ongoing demand for safe haven investments, so this could be the moment for copper stocks to shine.

However, it’s hard to know the best way to invest in copper. While the sector as a whole is seen as a stable investment, many individual copper stocks are still highly volatile. One option is to buy into a commodities ETF like CHRG. CHRG is a batteries commodity ETF that tracks the raw materials needed for the green energy ecosystem, including copper, lithium, and nickel.

An ETF like CHRG offers an actively managed, low cost and convenient way for retail investors to invest in a basket of the core green energy metals sector in a single purchase, and diversify their energy allocation to include this dynamic and fastest growing energy sub-sector.

[1] “Gold ETFs see first inflows in 10 months as banking crisis sparks safe-haven buying” April 10, 2023 https://www.kitco.com/news/2023-04-10/Gold-ETFs-see-first-inflows-in-10-months-as-banking-crisis-sparks-safe-haven-buying.html

[2] “Gold ETFs see first inflows in 10 months as banking crisis sparks safe-haven buying” April 10, 2023 https://www.kitco.com/news/2023-04-10/Gold-ETFs-see-first-inflows-in-10-months-as-banking-crisis-sparks-safe-haven-buying.html

[3] “Gold ETF Flows: March 2023” April 6, 2023 https://www.gold.org/goldhub/data/global-gold-backed-etf-holdings-and-flows

[4] “Bitcoin Breaches a Major Resistance to Form a Fresh 9-Month High on Safe-Haven Inflows and Goldilocks CPI” March 14, 2023 https://wccftech.com/bitcoin-breaches-a-major-resistance-to-form-a-fresh-9-month-high-on-safe-haven-inflows-and-goldilocks-cpi/

[5] “Investors believe the stock market is set for losses, and cash is best safe haven, CNBC survey shows” March 31, 2023 https://www.cnbc.com/2023/03/31/investors-believe-the-stock-market-is-set-for-losses-and-cash-is-best-safe-haven-cnbc-survey-shows.html

[6] Bloomberg Sector Performance, accessed May 2, 2023 https://www.bloomberg.com/markets/sectors/energy

[7] “Mohamed El-Erian: 10 Insights for Advisors When There’s ‘No Safe Haven'” May 27, 2022 https://www.thinkadvisor.com/2022/05/27/mohamed-el-erian-10-insights-for-advisors-when-theres-no-safe-haven/

[8] “Biden’s Inflation Reduction Act makes green hydrogen profitable at scale, Goldman Sachs says” November 30, 2022 https://www.cnbc.com/2022/11/30/the-ira-makes-green-hydrogen-profitable-at-scale-goldman-says.html

[9] Energy Policy Tracker — G20 Countries. Updated December 31, 2021 https://www.energypolicytracker.org/region/g20/

[10] “A guide to trading safe-haven assets” May 19, 2022 https://www.forex.com/en/market-analysis/latest-research/safe-havens/

[11] “5 Copper Stocks For 2023 And Beyond” December 20, 2022 https://www.forbes.com/sites/qai/2022/12/20/5-copper-stocks-for-2023-and-beyond/?sh=1a4944947f80

[12] “Investing in Copper Stocks” April 26, 2023 https://www.fool.com/investing/stock-market/market-sectors/materials/metal-stocks/copper-stocks/

[13] “5 Copper Stocks For 2023 And Beyond” December 20, 2022 https://www.forbes.com/sites/qai/2022/12/20/5-copper-stocks-for-2023-and-beyond/?sh=1a4944947f80

Investing in ETF’s involves risk, including possible loss of principal. International investing may be subject to special risks, including currency exchange rate volatility, political, social or economic instability, less publicly available information, less stringent investor protections, and differences in taxation, auditing and other financial practices. Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. The Fund invests in securities of companies of all sizes, including those that have relatively small market capitalizations. Investments in securities of these companies involve greater risks than do investments in larger, more established companies. Derivatives include instruments and contracts that are based on, and are valued in relation to, one or more underlying securities, financial benchmarks or indices, such as futures, options, swap agreements and forward contracts. The Adviser may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser may increase the volatility of the Fund. Because the Fund invests in financial instruments that are linked to different types of commodities from the metals sector, the Fund is subject to the risks inherent in the metals sector. Such risks may include, but are not limited to: general economic conditions or cyclical market patterns that could negatively affect supply and demand in a particular industry; changes in environmental conditions, energy conservation and environmental policies; competition for or depletion of resources; adverse labor relations; political or world events; increased regulatory burdens; changes in exchange rates; imposition of import controls; obsolescence of technologies; and increased competition or new product introductions. The exploration and development of mineral deposits involve significant financial risks over a significant period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. The Fund invests in companies that are economically tied to the lithium industry, which may be susceptible to fluctuations in the underlying commodities market. Commodity prices may be influenced or characterized by unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, changes in interest rates and monetary and other governmental policies, action and inaction. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated on a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns shown do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. NAVs are calculated using prices as of 4:00 PM Eastern Time.

The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF is distributed by Quasar Distributors, LLC.

Investors should carefully consider the investment objectives, risks, charges and expenses of the The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by calling 1-800-617-0004 or visiting www.emgadvisors.com. The Prospectus should be read carefully before investing.

Minnesota mining maze reveals the green energy dilemma

Sustainable energy and electric vehicles (EVs) will help pave the way to a cleaner, greener future and many countries have committed to bringing this to reality. Achieving those goals could conflict with a desire to protect unspoiled natural areas, and/or engender a level of dependency on authoritarian nations. Through this dilemma, however, we have identified an investment opportunity via some kind of copper ETF or perhaps a wider scope one like the CHRG ETF. What do investors need to know about the raw materials needed for green energy?

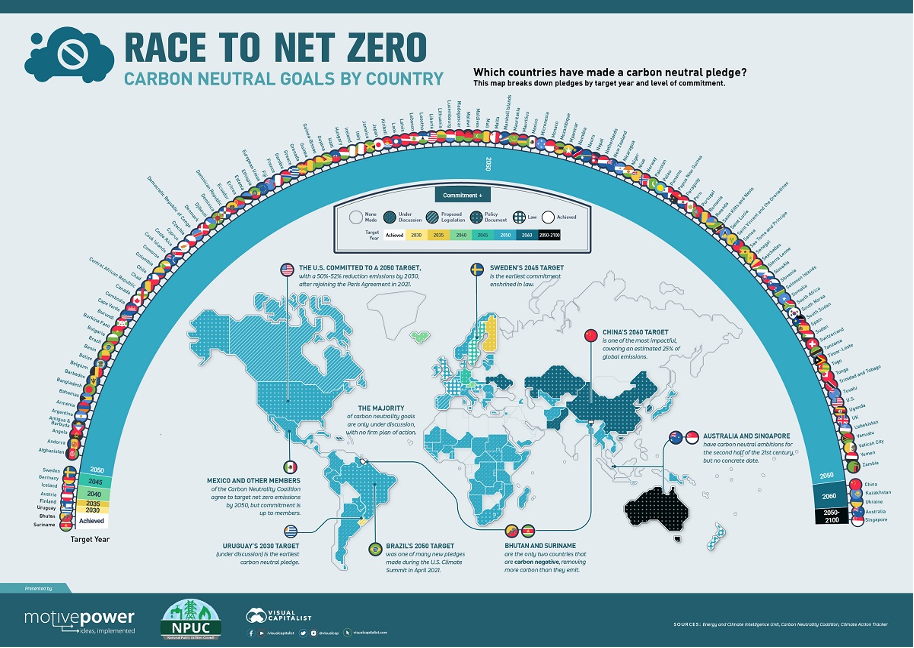

Global carbon commitments abound, but action is limited

On paper, the planet is as good as saved. 196 countries signed the Paris Agreement in 2015, pledging to take action to limit global temperature rise to below 2℃ above pre-industrial levels, and more have joined in the following years[1].

Since 2015, 37 countries have committed to carbon neutrality;[2] 6 nations, including the UK, France, and Denmark, have turned their commitment into law; and another 24 have enshrined it as part of government policy, including the US, Brazil, Chile, and Germany.[3]

Source: “Race to Net Zero: Carbon Neutral Goals by Country” Last updated July 20, 2022. https://www.visualcapitalist.com/sp/race-to-net-zero-carbon-neutral-goals-by-country/

But the UN’s Net Zero Coalition warns that current plans fall a long way short of what is required. Only 8 countries have achieved net zero thus far, most of which are tiny island nations[4]. According to the Net Zero Coalition, today’s commitments will actually see global greenhouse gas emissions increase by almost 11% above 2010 levels by 2030.[5]

There’s a major gap between intentions and action, which is hardly surprising. Few people are willing to significantly change their lifestyle today for the sake of averting a nebulous future disaster. Governments and organizations won’t hit their targets by simply cutting energy consumption.

Sustainable energy is the missing piece

What is needed is a climate-friendly, non-harmful energy alternative which allows people to continue to enjoy the ease of transportation, access to fresh produce and manufactured goods, and temperature control (air conditioning) that is currently available. In other words, sustainable energy from renewable sources, and electric vehicles (EVs) which use that energy.

Many countries have consequently passed laws incentivizing green energy production, and are investing in the necessary infrastructure and R&D. The Energy Policy Tracker calculates that in 2020-2021, governments in G20 countries[1] [2] , which constitute the highest-polluting countries in the world, committed at least $326.13 billion for potentially clean energy and over $204.11 billion for other green energy.[6]

These figures sound impressive, but they are not sufficient. The UN’s Framework Convention on Climate Change (UNFCCC) recently promoted a multi-agency report by the World Meteorological Organization (WMO). The report emphasized that in order to limit global temperature increase, the supply of sustainable energy must double within the next 8 years and investments must triple by 2050. Only 40% of climate action plans submitted to the UNFCCC prioritize energy adaptation, and investment is correspondingly low.[7]

“Switching to clean forms of energy generation, such as solar, wind and hydropower […] is vital if we are to thrive in the twenty-first century. Net zero by 2050 is the aim. But we will only get there if we double the supply of low-emissions electricity within the next eight years,” said WMO Secretary-General Professor Petteri Taalas.[8]

This is encouraging news for investors with the foresight to invest in futures markets for the vital commodities needed to enable renewable energy. Over the next several years, massive amounts of lithium, cobalt, copper, nickel, and other specific raw materials are going to be needed for EVs, lithium-ion batteries for storing renewable energy, pipelines for alternative fuels, and more.

However, accessing those raw materials is leading to unexpected conflicts.

The sustainability tug of war

“Ensuring secure, resilient and sustainable EV supply chains” is one of the 5 recommendations made by the IEA [3] (International Energy Agency) to support the development of Evs,[9] but it’s proving tricky to actualize. The aforementioned elements come from mines, many located in unstable nations such as the Democratic Republic of Congo, or controlled by repressive regimes such as China and Russia. Environmentally-aware nations are forced to choose between funding war and repression, or blocking the production of vital green energy infrastructure.

Many countries are searching for alternative sources of raw materials. But when such sources are found, they can provoke a conflict of interests. Mining is a destructive process that can harm existing ecosystems, but blocking it means forbidding access to the commodities needed to support a more planet-friendly way of life.

The conflict was thrown into sharp relief by recent events in the US, in the state of Minnesota. In 2019, Chilean mining company Antofagasta discovered a rich source of copper and nickel in northeast Minnesota, and proposed to develop an underground mine. The mine would help Antofagasta fill its copper deficit, and serve as the country’s only nickel mine, since the existing one is set to close by 2025.[10]

Permission was granted by the Trump administration, but a group of local businesses, environmental advocates and outdoor recreation groups challenged that ruling. On January 26, 2023, the Interior Secretary officially withdrew the land from the lease, preventing mining for at least the next 20 years.[11]

Just 11 days later, Minnesota’s governor signed a bill into law that requires all the state’s utilities to produce carbon-free electricity by 2040.[12] But without opening up areas of the natural world for mining, there will be no way to meet long-term climate goals. Minnesota has effectively tied its own hands.

Moving towards a cleaner future

It’s clear that the US needs to come up with a comprehensive plan for meeting carbon neutral goals, one which balances preserving areas of pristine nature, enabling sustainable energy and pollution-free transport, and reducing dependency on authoritarian regimes. Like other countries, it will have to take bold decisions that might temporarily sacrifice access to nature preserves in exchange for long term environmental improvements.

As nations face up to the need for raw materials to support their carbon commitments, and decide which path they will take to access them, investors can seize the opportunity. An ETF that offers broad exposure to the rising value of such commodities, like some types of copper ETFs [4] or other ETFs focused on core commodities, presents a way to benefit from the increasing demand for raw materials and support green energy.

[1] “The Paris Agreement” https://unfccc.int/process-and-meetings/the-paris-agreement

[2] “Race to Net Zero: Carbon Neutral Goals by Country” Last updated July 20, 2022 https://www.visualcapitalist.com/sp/race-to-net-zero-carbon-neutral-goals-by-country/

[3] “Race to Net Zero: Carbon Neutral Goals by Country” Last updated July 20, 2022 https://www.visualcapitalist.com/sp/race-to-net-zero-carbon-neutral-goals-by-country/

[4] “These 8 countries have already achieved net-zero emissions” December 16, 2022 https://www.weforum.org/agenda/2022/12/these-countries-achieved-net-zero-emissions/

[5] “For a livable climate: Net-zero commitments must be backed by credible action” 2022 https://www.un.org/en/climatechange/net-zero-coalition

[6] Energy Policy Tracker — G20 Countries. Updated December 31, 2021 https://www.energypolicytracker.org/region/g20/ . G20 countries are Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Türkiye, the United Kingdom, the United States, and the European Union.

[7] “WMO – Clean Energy Must Double By 2030” October 11, 2022 https://unfccc.int/news/wmo-clean-energy-must-double-by-2030

[8] “WMO – Clean Energy Must Double By 2030” October 11, 2022 https://unfccc.int/news/wmo-clean-energy-must-double-by-2030

[9] “Global EV Outlook 2022” 2022 https://iea.blob.core.windows.net/assets/e0d2081d-487d-4818-8c59-69b638969f9e/GlobalElectricVehicleOutlook2022.pdf

[10] “US blocks mining in parts of Minnesota, dealing blow to Antofagasta’s Twin Metals copper project” January 26, 2023 https://www.mining.com/web/us-blocks-mining-in-parts-of-minnesota-dealing-latest-blow-to-antofagastas-copper-project/

[11] “US blocks mining in parts of Minnesota, dealing blow to Antofagasta’s Twin Metals copper project” January 26, 2023 https://www.mining.com/web/us-blocks-mining-in-parts-of-minnesota-dealing-latest-blow-to-antofagastas-copper-project/

[12] “Minnesota just passed a 100% clean energy bill – here’s what’s in it” February 7, 2023 https://electrek.co/2023/02/07/minnesota-just-passed-a-100-clean-energy-bill-heres-whats-in-it/

Investing in ETF’s involves risk, including possible loss of principal. International investing may be subject to special risks, including currency exchange rate volatility, political, social or economic instability, less publicly available information, less stringent investor protections, and differences in taxation, auditing and other financial practices. Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. The Fund invests in securities of companies of all sizes, including those that have relatively small market capitalizations. Investments in securities of these companies involve greater risks than do investments in larger, more established companies. Derivatives include instruments and contracts that are based on, and are valued in relation to, one or more underlying securities, financial benchmarks or indices, such as futures, options, swap agreements and forward contracts. The Adviser may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser may increase the volatility of the Fund. Because the Fund invests in financial instruments that are linked to different types of commodities from the metals sector, the Fund is subject to the risks inherent in the metals sector. Such risks may include, but are not limited to: general economic conditions or cyclical market patterns that could negatively affect supply and demand in a particular industry; changes in environmental conditions, energy conservation and environmental policies; competition for or depletion of resources; adverse labor relations; political or world events; increased regulatory burdens; changes in exchange rates; imposition of import controls; obsolescence of technologies; and increased competition or new product introductions. The exploration and development of mineral deposits involve significant financial risks over a significant period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. The Fund invests in companies that are economically tied to the lithium industry, which may be susceptible to fluctuations in the underlying commodities market. Commodity prices may be influenced or characterized by unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, changes in interest rates and monetary and other governmental policies, action and inaction. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated on a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns shown do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. NAVs are calculated using prices as of 4:00 PM Eastern Time.

The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF is distributed by Quasar Distributors, LLC.

Investors should carefully consider the investment objectives, risks, charges and expenses of the The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by calling 1-800-617-0004 or visiting www.emgadvisors.com. The Prospectus should be read carefully before investing.

Why Carbon Targets are Unrealistic

“Commitment is what transforms a promise into reality.” – Abraham Lincoln

Which countries have committed to carbon emissions standards, and how do they hope to achieve them? How could carbon commitments affect the markets? Is the time ripe to focus on commodities that are central to global green initiatives by investing in a lithium, nickel, cobalt, and copper ETF?

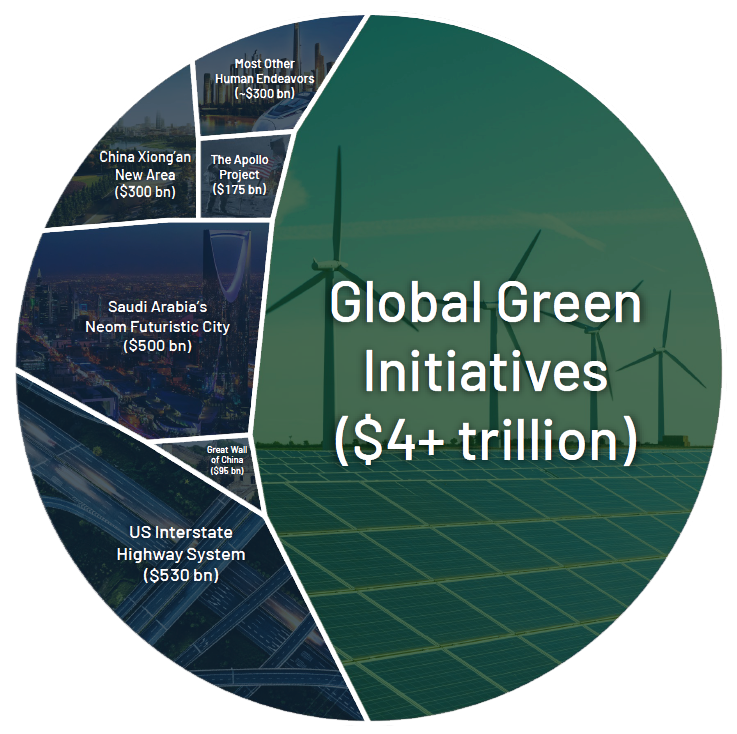

Race to net-zero emissions dwarfs the cost of all other mega projects (in today’s dollars)

There are massive commitments to net zero; over $4 trillion between the United States, European Union, and China to be spent within the next decade. To understand the sheer scale of the effort, the visual below illustrates where we are in terms of committed fiscal expenditures on green initiatives in comparison to past human endeavors.

We believe these commitments crush any comparison between today’s “green bubble” (and the bubble it could become), and bubbles of the past; the world’s governments weren’t committing trillions of dollars to the Dot Com era technology transition.

The Paris Agreement

The Paris Agreement, signed in 2015, is a global agreement within the United Nations Framework Convention on Climate Change (UNFCCC) aimed at mitigating the impact of global warming and climate change. The agreement seeks to limit global temperature rise to “well below 2 degrees Celsius above pre-industrial levels and to make efforts to limit it to 1.5 degrees Celsius.”[1]

A key element of the agreement is the Enhanced Transparency Framework, in which countries expressed their willingness to regularly report on their carbon emissions, also called greenhouse gas emissions, and to make continual progress towards reducing them. While the Paris Agreement does not impose specific limits on carbon emissions for individual countries, it requires that all countries make nationally-determined contributions (NDCs) towards lowering their emissions and strengthening these contributions over time.

Reducing emissions through EVs

Climate neutrality is the act of bringing down greenhouse gas emissions as close to zero as possible. This shift will take years for most countries to accomplish, due to the change of habits and investment in technology it requires.

Countries throughout the world have begun taking steps toward improving energy efficiency, increasing their use of renewable energy sources, and reducing emissions from industry, building, and transportation. These commitments are a crucial component of a sustainable, low-carbon future.

Promoting the use of electric vehicles, or EVs, is an important step many countries have taken to achieve their carbon emissions goals and eventually reach climate neutrality, as EVs do not emit pollutants. They also save drivers money in fuel costs, require lower maintenance, and have performance benefits over gas-powered vehicles.

Investment Opportunity

Global carbon commitments are not just good for the earth. They also benefit the futures market for the core commodities required to implement carbon-neutral solutions. EVs rely on lithium, nickel, cobalt, and significant amounts of copper wire. Demand for these raw materials is expected to soar as the world aims for net zero emissions.[2]

Global goals

Most of the world’s emissions come from just a few countries.[3] The top seven emitting countries accounted for about half of the world’s greenhouse gas emissions in 2020, and The Group of 20 is responsible for about 75% of greenhouse gas emissions globally.[4] As part of the Paris Agreement, the highest carbon emitting countries have set net zero pledges they aim to achieve in the coming years:

- The European Union has set a target to reduce its greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels and achieve climate neutrality by 2050.[5] To achieve this goal, the EU is promoting the use of EVs and other low-emission modes of transportation. The EU has also made strides to further the use of renewable energy sources such as solar and wind power and is implementing measures to improve energy efficiency in buildings and industry.

- China has also made ambitious carbon commitments as the world’s largest emitter of greenhouse gasses. China has pledged to reach peak carbon emissions by 2030 and achieve carbon neutrality by 2060. China has been investing heavily in renewable energy sources and has implemented measures to improve energy efficiency and reduce emissions from transportation and industry to make these goals attainable. One of several policy recommendations needed for China to make this shift is “accelerating electrification in private and commercial vehicles and providing adequate charging infrastructure.”[6]

- The US is the world’s second-largest emitter of greenhouse gases. President Biden’s National Climate Task Force pledged to reduce greenhouse gas emissions by 50-52% below 2005 levels in 2030, reach 100% carbon pollution-free electricity by 2035, and achieve net-zero emissions by no later than 2050.[7]

- India is the world’s third-largest emitter of greenhouse gases. India’s carbon commitments include setting a target to reduce its emissions intensity by 45% by 2030 compared to 2005 levels. India is implementing measures to improve energy efficiency in transportation and industry, as well as promoting the use of renewable energy sources. India’s Production Linked Incentive plan will, among other initiatives, increase the manufacture of low-emissions products like EVs, super-efficient appliances, and innovative technologies like green hydrogen.[8]

- Many other countries around the world have also made carbon commitments as part of the Paris Agreement.[9] These commitments are critical in addressing the impact of climate change and are an important step towards a sustainable, low-carbon future.

The drive to change

Countries that have made carbon commitments have introduced legislation incentivizing EVs[10] and limiting the sales of cars that rely on fossil fuels.[11] These pledges to reduce greenhouse gas emissions will likely continue to impact the value of commodities used to make batteries for electric vehicles. Global demand for lithium, cobalt, nickel, and copper has sharply risen and is likely to outpace supply over the coming decades.[12]

Car manufacturers have been rapidly bringing EVs to market. While it is yet unclear which EV manufacturers will come out ahead, one thing is certain: All EVs will rely on the core raw materials used to produce the batteries they run on: lithium, nickel, cobalt, and manganese, as well as the copper wire that connects them. Savvy investors will likely want to consider a lithium, cobalt or copper ETF that prioritizes this key commodity used in EV batteries. EMG’s CHRG ETF combines exposure to the futures market of a range of core commodities essential in any EV battery or other carbon-neutral solutions – Lithium, Nickel, Copper and Cobalt. As countries around the world renew and strengthen their carbon commitments, effective exposure to these commodities becomes an increasingly attractive option for investors

[1] “The Paris Agreement. What is the Paris agreement?” www.unfccc.int

[2] “The raw-materials challenge: How the metals and mining sector will be at the core of enabling the energy transition.” January 10, 2022. www.mckinsey.com

[3] “For a livable climate: Net-zero commitments must be backed by credible action.” www.un.org

[4] “G-20 nations have gathered to talk carbon emissions. The negotiations won’t be easy.” August 31st, 2022. www.cnbc.com

[5] “2030 Climate Target Plan.” www.climate.ec.europa.eu

[6] “China’s Transition to a Low-Carbon Economy and Climate Resilience Needs Shifts in Resources and Technologies.” October 12th, 2022. www.worldbank.org

[7] “Take Climate Action in Your Community” www.whitehouse.gov

[8] “Cabinet approves India’s Updated Nationally Determined Contribution to be communicated to the United Nations Framework Convention on Climate Change.” August 3rd, 2022. www.pib.gov.in

[9] www.zerotracker.net

[10] “Credits for New Clean Vehicles Purchased in 2023 or After.” January 25th, 2023. www.irs.gov

[11] “EU approves effective ban on new fossil fuel cars from 2035.” October 28th, 2022. www.reuters.com

[12] “The demand for electric vehicles is skyrocketing. Can the supply of lithium and other critical minerals for batteries keep up?” October 4th, 2022. www.grid.news

Investing in ETF’s involves risk, including possible loss of principal. International investing may be subject to special risks, including currency exchange rate volatility, political, social or economic instability, less publicly available information, less stringent investor protections, and differences in taxation, auditing and other financial practices. Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. The Fund invests in securities of companies of all sizes, including those that have relatively small market capitalizations. Investments in securities of these companies involve greater risks than do investments in larger, more established companies. Derivatives include instruments and contracts that are based on, and are valued in relation to, one or more underlying securities, financial benchmarks or indices, such as futures, options, swap agreements and forward contracts. The Adviser may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser may increase the volatility of the Fund. Because the Fund invests in financial instruments that are linked to different types of commodities from the metals sector, the Fund is subject to the risks inherent in the metals sector. Such risks may include, but are not limited to: general economic conditions or cyclical market patterns that could negatively affect supply and demand in a particular industry; changes in environmental conditions, energy conservation and environmental policies; competition for or depletion of resources; adverse labor relations; political or world events; increased regulatory burdens; changes in exchange rates; imposition of import controls; obsolescence of technologies; and increased competition or new product introductions. The exploration and development of mineral deposits involve significant financial risks over a significant period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. The Fund invests in companies that are economically tied to the lithium industry, which may be susceptible to fluctuations in the underlying commodities market. Commodity prices may be influenced or characterized by unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, changes in interest rates and monetary and other governmental policies, action and inaction. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated on a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns shown do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. NAVs are calculated using prices as of 4:00 PM Eastern Time.

The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF is distributed by Quasar Distributors, LLC.

Investors should carefully consider the investment objectives, risks, charges and expenses of the The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by calling 1-800-617-0004 or visiting www.emgadvisors.com. The Prospectus should be read carefully before investing.

Who is going to win the race for electric vehicles?

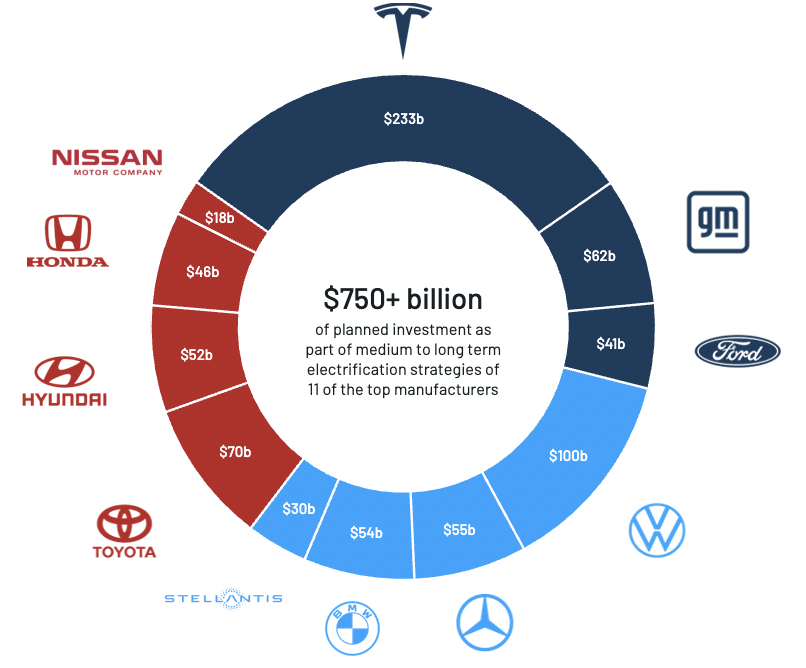

Electric vehicles (EVs) are frequently in the news as the most viable green alternative to gas-fueled internal combustion engines, promising the same convenient travel with a smaller carbon footprint. Investing in EV adoption by picking which car manufacturer will win is difficult. One thing is clear; every EV will use batteries, and these batteries will be made using some combination of lithium, nickel, and cobalt, connected with up to a mile of copper wire.

These vital metals are undersupplied and prices will only heat up as demand grows. That’s why EV investors can’t afford to miss the latest futures ETF CHRG, which differs from other battery ETFs by providing potentially lucrative access.

Which companies are investing in EV?

Tesla has long been synonymous with “electric car,” but today there are dozens of brands jostling for market share, including startups like Rivian, Lucid, and Nio, leading traditional carmakers like GM and Ford in the US; Volkswagen, Daimler, Renault and BMW in Europe; Nissan, Toyota, Hyundai, and Honda in Asia. If you have your eyes on a battery ETF then it’s worth first getting familiar with the EV market.

Here are the main EV companies to keep your eye on.

1. Tesla

Tesla has the biggest share of the market and consumer attention, producing over 365,000 vehicles in Q3 2022[1]. It presides over extensive EV infrastructure, including the largest fast charging network in the world[2] and six factories[3], and stands to benefit from the recent Inflation Reduction Act (IRA), under which all Tesla models are eligible for tax credits[4]. “There’s no question Tesla’s winning the race right now, by a wide margin,” said Michelle Krebs, executive analyst at Cox Automotive[5].

However, that could change. John Murphy, managing director and lead auto analyst at Bank of America Merrill Lynch, predicts its market share will decline from 70% in 2021 to the low teens by 2025, due to competition from other manufacturers[6]. It’s also grappling with challenges including quality issues and labor shortages, and falling behind with new models. Tesla’s Q3 2022 earnings call left analysts uneasy, and shares dropped 47% in price over the course of 2022[7]. That said, its name recognition, industry expertise, and aforementioned infrastructure mean it’s still well placed to stay in the top centile of the market.

Battery Composition: The types of batteries that EV makers like Tesla use are always changing, often from model to model. Tesla itself uses a range of batteries, including high-lithium batteries, high nickel batteries with cobalt and manganese, and silicon anode batteries that use lithium together with silicon.

2. Volkswagen

With years of green policies and subsidies for alternative energies, the EV market in Europe is far ahead of the US, giving European carmakers a leg up. As Europe’s biggest EV producer, Volkswagen is one of the top traditional carmakers in the electric vehicles market. It currently captures approximately 25% of Europe’s EV market[8] and lies just behind BYD and Tesla in EV sales[9].

Volkswagen is pouring investment into its EV division, expecting to spend around €52 billion on electrification through 2026. It has grand plans, aiming to become the world’s biggest EV seller by 2025[10] and raise the share of sales from electric vehicles, from 5.1% in 2021 to 50% by 2030[11].

Battery Composition: Volkswagen and Ford are noteworthy for using some of the biggest range of battery types, from lithium, nickel, and cobalt batteries to solid state batteries that require less cobalt, high nickel batteries, and high lithium batteries.

3. Ford

The US lags behind in electrification, but recent policies encouraging clean energy, including the Inflation Reduction Act, may move it ahead in the next few years as US based automotive leaders funnel money into EV development. Ford and GM are battling it out, and could overtake Tesla as the market expands and there’s more demand for affordable models.[12]

Ford is ahead of GM at the moment, thanks to hit models like the E-Transit commercial van, Mustang Mach-E SUV, and the F-150 Lightning pickup, which sold out quickly. It has strong brand loyalty, expects 40-60% of its vehicles to be electric by 2030[13], and is currently beating GM on sales and shopping data[14].

Battery Composition: Like Volkswagen, Ford needs lithium, nickel, cobalt, phosphate, and more for its long list of battery types.

4. GM

GM’s potential to leapfrog Ford lies in its technological innovation. GM developed the Ultium flexible battery architecture that allows the company to produce EV batteries on a massive scale and at lower cost, which will in turn bring down the price of its EVs[15]. Price is the battlefield that GM has chosen, with CEO Mary Barra saying “That’s the long game we are playing, and I’m here to win.[16]” In line with this philosophy, GM uses only two kinds of batteries: solid state batteries using lithium, nickel, and phosphate, or high nickel batteries that also require cobalt and manganese.

GM has begun building four battery manufacturing plants together with LG Electric, the first of which started operations in 2022[17], and aims to invest over $35 billion in EVs by 2025[18] and produce 1 million EVs each year by 2026[19]. In contrast, Ford’s planned battery plants won’t begin production for at least 2 years, and still has to retool its assembly plants for the new batteries[20].

GM has a long list of EV models for release over the next year or so, including the GMC Hummer EV Pickup, the Cadillac Lyriq SUV, and Blazer and Equinox utility vehicles[21], which could bring it up to or ahead of Ford in EV sales.

Other EV companies for the investor watchlist include Rivian, an American startup that sold Amazon its electric delivery vans. 1,000 vans with lithium, iron ore, and phosphate batteries are already on the road, and Amazon plans to add another 10,000[22]. Rivian sold 6,584 vehicles in Q3 2022, with batteries that use lithium, mostly nickel, or nickel, cobalt, and manganese, and recently announced plans to add a second manufacturing plant which will come online by 2024.[23]

EV Batteries will be a constant need

EV use goes beyond sedans with relatively small batteries to larger vehicles like SUVs and pickups, as well as electric buses, vans, and trucks, which require larger batteries and more raw materials. But the core elements necessary for development are consistent across manufacturers: lithium, nickel, cobalt, and copper.

Supplies of these vital components are already low, pushing prices up to the extent that lithium is near historic highs[24]. The problem is compounded by the fact that supply is concentrated in certain areas of the world, many of which are unstable and/or under totalitarian regimes which are or may soon be under sanctions. The uncertainty around supply only drives prices higher. As more large EVs take to the roads, even greater pressure will be put on the supply chain, offering an attractive opportunity for investors.

Even at the current page of adoption, global supply cannot satisfy forecasted demand

Selected battery raw materials supply / demand forecasts

An EV component futures ETF beckons

The car industry already requires massive amounts of these raw materials, and this need will only continue to grow. Automakers rely on lithium, nickel, cobalt and copper, plus significant amounts of other metals like aluminum, manganese, and iron are also crucial. This makes a futures ETF like CHRG, that actively tracks the prices of essential commodities for EV batteries, an option for investors that want to benefit from the market’s explosive growth without guessing which EV maker will triumph.

No matter which carmaker takes the crown from Tesla or captures the European market, it will still need the same commodities for its EV batteries. A regular battery ETF targets companies; CHRG is a futures ETF for lithium, cobalt, nickel, and copper. It is rebalanced monthly by a team with 70 combined years of experience in metals and mining. CHRG offers a deeper perspective for investors looking beyond the car manufacturers for exposure to the burgeoning EV market.

EMG Advisors holds 0% holdings in BMW, Daimler, Ford, GM, Honda, Hyundai, Lucid, Nio, Nissan, Renault, Vivian, Toyota, and Volkswagen – click here to view current holdings. Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security.

[1] “5 Biggest Electric Car Companies in the World” November 4, 2022 www.insidermonkey.com

[2] “Tesla Is No Longer Alone in the Electric Vehicle Race” October 25, 2022 time.com

[3] “5 Biggest Electric Car Companies in the World” November 4, 2022 www.insidermonkey.com

[4] “Hyundai is catching up with Tesla in the global EV race” August 23, 2022 www.ft.com

[5] “Who’s Winning America’s Electric Vehicle Race?” April 27, 2022 www.cnet.com

[6] “Tesla Is No Longer Alone in the Electric Vehicle Race” October 25, 2022 www.time.com

[7] “Tesla Is No Longer Alone in the Electric Vehicle Race” October 25, 2022 www.time.com

[8] “Top Electric Car Companies: BYD overtook Tesla in 2022” July 6, 2022 ww.mobilityarena.com

[9] “China’s BYD Winning 2022 Electric Vehicle Sales Race” December 21, 2022 www.about.bnef.com

[10] “China’s BYD Winning 2022 Electric Vehicle Sales Race” December 21, 2022 www.about.bnef.com

[11] “5 Stocks That May Dominate the EV Space in the Next 5 Years” February 5, 2022 www.fool.com

[12] “Tesla Is No Longer Alone in the Electric Vehicle Race” October 25, 2022 www.time.com

[13] “5 Stocks That May Dominate the EV Space in the Next 5 Years” February 5, 2022 www.fool.com

[14] “Who’s Winning America’s Electric Vehicle Race?” April 27, 2022 www.cnet.com

[15] “38 Electric Car Companies Shaping the Future of Travel” December 6, 2022 www.builtin.com

[16] “Mary Barra’s ‘Long Game’: Winning the E.V. Race” May 12, 2022 www.nytimes.com

[17] “Mary Barra’s ‘Long Game’: Winning the E.V. Race” May 12, 2022 www.nytimes.com

[18] “Who’s Winning America’s Electric Vehicle Race?” April 27, 2022 www.cnet.com

[19] “Mary Barra’s ‘Long Game’: Winning the E.V. Race” May 12, 2022 www.nytimes.com

[20] “Mary Barra’s ‘Long Game’: Winning the E.V. Race” May 12, 2022 www.nytimes.com

[21] “Who’s Winning America’s Electric Vehicle Race?” April 27, 2022 www.cnet.com

[22] “Amazon says it has more than a thousand electric Rivian vans making deliveries across the US — see how they were designed” November 8, 2022 www.businessinsider.com

[23] “15 Biggest Electric Car Companies in the World” November 4, 2022 www.fiance.yahoo.com

[24] “Hyundai is catching up with Tesla in the global EV race” August 23, 2022 www.ft.com

Investing in ETF’s involves risk, including possible loss of principal. International investing may be subject to special risks, including currency exchange rate volatility, political, social or economic instability, less publicly available information, less stringent investor protections, and differences in taxation, auditing and other financial practices. Investment in emerging market securities involves greater risk than that associated with investment in foreign securities of developed foreign countries. The Fund invests in securities of companies of all sizes, including those that have relatively small market capitalizations. Investments in securities of these companies involve greater risks than do investments in larger, more established companies. Derivatives include instruments and contracts that are based on, and are valued in relation to, one or more underlying securities, financial benchmarks or indices, such as futures, options, swap agreements and forward contracts. The Adviser may engage in speculative transactions which involve substantial risk and leverage, such as making short sales. The use of leverage by the Adviser may increase the volatility of the Fund. Because the Fund invests in financial instruments that are linked to different types of commodities from the metals sector, the Fund is subject to the risks inherent in the metals sector. Such risks may include, but are not limited to: general economic conditions or cyclical market patterns that could negatively affect supply and demand in a particular industry; changes in environmental conditions, energy conservation and environmental policies; competition for or depletion of resources; adverse labor relations; political or world events; increased regulatory burdens; changes in exchange rates; imposition of import controls; obsolescence of technologies; and increased competition or new product introductions. The exploration and development of mineral deposits involve significant financial risks over a significant period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. The Fund invests in companies that are economically tied to the lithium industry, which may be susceptible to fluctuations in the underlying commodities market. Commodity prices may be influenced or characterized by unpredictable factors, including, where applicable, high volatility, changes in supply and demand relationships, weather, agriculture, trade, changes in interest rates and monetary and other governmental policies, action and inaction. Securities of companies held by the Fund that are dependent on a single commodity, or are concentrated on a single commodity sector, may typically exhibit even higher volatility attributable to commodity prices.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns shown do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. NAVs are calculated using prices as of 4:00 PM Eastern Time.

The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF is distributed by Quasar Distributors, LLC.

Investors should carefully consider the investment objectives, risks, charges and expenses of the The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by calling 1-800-617-0004 or visiting www.emgadvisors.com. The Prospectus should be read carefully before investing.